Key Takeaways

- The data center warehousing and logistics service providers sector is not about typical freight. It is a specialized, premium sector characterized by high complexity, high value per shipment, and significant switching costs once integrated. These structural features establish sustainable economics that are not available to generalist providers.

- The $6.7 trillion buildout is limited by execution, not capital availability. Power supply constraints, equipment shortages, and commissioning schedules have turned warehousing and logistics from a back-office expense into a strategic asset that justifies premium prices.

- Arvato’s acquisition of ATC signals where value is migrating. The deal was a capability acquisition, not a capacity play. Arvato bought an operating system for hyperscale deployments and a lifecycle service model designed to generate recurring, sticky revenue.

- Lifecycle positioning is the moat. Providers who embed themselves across construction, operations, maintenance, modernization, and decommissioning create switching costs that grow over time. One-time projects become long-term service relationships.

- The key strategic question isn’t about market size but about defensibility. Can your organization become the entrenched lifecycle operator that customers can’t afford to leave?

When Arvato, the global supply chain giant owned by Bertelsmann, acquired ATC Computer Transport & Logistics in January 2025, the deal barely made waves in mainstream business coverage. No splashy valuation figures. No breathless commentary about AI infrastructure. Just an announcement about “new opportunities in the rapidly growing data center services market.”

Arvato wasn’t just buying trucks or warehouse space; it was gaining something far more valuable: an operating model and execution framework for hyperscale data center deployments, and a foothold in one of the most defensible niches in the infrastructure buildout that will shape the next decade.

For CEOs and private equity owners in this industry, the Arvato-ATC deal offers a strategic lesson about where true value lies. The answer isn’t in building data centers. It’s in becoming so deeply integrated into their operations that customers think twice before they decide to replace a partner that is deeply embedded in their infrastructure.

Peter Drucker observed that “results are obtained by exploiting opportunities, not by solving problems.” The opportunity in data center warehousing and logistics isn’t just solving the problem of moving equipment. It’s about exploiting the structural conditions that make specialized execution extremely valuable.

The Multi-Trillion Buildout Nobody Can Execute Fast Enough

The scale of what’s ahead is enormous. McKinsey predicts that data centers will need around $6.7 trillion in global investment by 2030 to meet demand. The construction market supporting this is also expected to almost double, from $241 billion in 2024 to $457 billion by 2030.

But here’s what those top-line numbers hide: the buildout is limited not by capital but by execution capacity. CBRE reports that the North American power supply under construction reached a record 6,350 MW at the end of 2024, with timelines stretched due to power availability and supply chain bottlenecks. Critical equipment, including generators, chillers, and transformers, remains in chronic shortage. Construction and equipment costs continue to rise.

In this setting, warehousing and logistics shifts from a merely back-office expense to a crucial element: schedule assurance. When every commissioning milestone relies on accurate equipment delivery, proper handling, and secure acceptance, the 3WPL partner effectively becomes part of the construction plan itself.

Drucker’s dictum holds especially true here: “There is nothing so useless as doing efficiently that which should not be done at all.” In data center warehousing and logistics, the opposite is equally valid: there is nothing more valuable than doing excellently what must be done correctly.

What Makes Data Center Warehousing and logistics a Premium Vertical

The data center warehousing and logistics market is valued at approximately $22.68 billion in 2025, projected to reach $34.84 billion by 2030. However, these figures conceal an important structural reality: the high-margin profit pools are unevenly distributed, and the “specialist lifecycle” segment has economics that differ significantly from traditional freight and warehousing.

Three characteristics establish this as a fundamentally different business.

Complexity creates barriers to entry. Data center deployments require precise site access windows, strict chain-of-custody protocols, and highly coordinated last-mile execution. Consider what ATC calls “rack and stack”: hundreds or thousands of server racks must be carefully placed on raised floors, connected to power and data infrastructure, and integrated into production environments, often under security protocols that rival those of classified government facilities. This complexity pushes buyers toward proven specialists. The lowest-price carrier is, almost by definition, disqualified.

Value density influences pricing behavior. The assets being warehoused and transported are expensive, sensitive, and time-critical. A single delayed shipment can lead to millions of dollars in schedule slippage. Leading integrators explicitly promote traceable chains of custody and condition monitoring because customers are willing to pay for risk reduction, not just miles traveled.

Embedded operations make switching cost-prohibitive, which is a key structural feature. Once a provider integrates into site credentialing, security procedures, standard operating protocols, systems for tracking and compliance, and recurring flows like spares and reverse logistics, it becomes operationally difficult and risky to remove them. The provider shifts from being just a vendor to becoming an essential part of the enterprise’s core functions.

ATC’s service catalog clearly outlines this strategy: secure warehousing, secure tech transport, white-glove delivery, rack-and-stack, reverse logistics, critical spare parts, migration, and decommissioning. These aren’t standalone offerings. They are part of a lifecycle relationship that creates strong operational integration, making it both valuable and more complex to walk away from over time.

The Value-Defensibility Matrix

Understanding where premium economics concentrate requires mapping service types against two dimensions: operational complexity and switching cost depth.

Strategic implication: Arvato’s acquisition of ATC is a conscious move from the lower-left to the upper-right quadrant, where high complexity and high switching costs converge. This is where premium margins and a strong competitive advantage align.

Why “Generalist 3WPL” Is No Longer Enough

The competitive landscape is dividing. On one side, global integrators compete on reach, standardized processes, and visibility tools. DHL manages data center logistics with a traceable chain of custody for both forward and reverse flows. Kuehne+Nagel emphasizes white-glove delivery, including unpacking, equipment positioning, and removal of packaging. DB Schenker, now part of DSV, promotes real-time reporting with custom dashboards for shipments, inventory, and KPIs.

On the other side are niche specialists like ATC, whose differentiation isn’t based on network size but on precise execution in hyperscale environments combined with onsite technical services that pure logistics operators typically cannot provide.

The market is shifting toward lifecycle packages that combine physical execution with digital visibility and proof of compliance. Generalist 3WPLs that compete mainly on price will find themselves pushed out of the premium segments where margins and growth are high.

Drucker warned that “the greatest danger in times of big change is not the change itself, it is to act with yesterday’s logic.” For logistics providers, yesterday’s logic emphasizes scale and cost efficiency. Tomorrow’s logic shifts focus to embedded complexity and switching costs. The Arvato-ATC deal is a move and a bet toward tomorrow’s logic.

Anatomy of a Capability Acquisition

Arvato’s public statements about the ATC deal clearly outline their strategic goal. The company describes the combined offering as “a portfolio that covers the entire data center lifecycle” from construction, operations, maintenance, modernization, and all the way to decommissioning. This framing is deliberate, as it indicates a fundamental shift in the economic model.

Construction yields episodic, project-based revenue. Operations and maintenance provide ongoing revenue through spare parts warehousing and logistics, break-fix swaps, returns, and consistent site support. Modernization establishes predictable refresh cycles aligned with technology upgrade schedules. Decommissioning, which is becoming more important for sustainability compliance and data security, generates organized reverse flows and asset disposition services.

That progression transforms a one-time transaction into a long-term service relationship with higher retention and better unit economics.

The acquisition positions Arvato to participate further up the value chain, particularly in services that tend to command premium pricing, stronger security requirements, higher technical standards, greater liability exposure, more program management responsibility, and expanded value-added services at the customer site.

Critically, this was a capability acquisition, not a capacity one. ATC brought a skilled specialist workforce with hyperscale credentials that would take years to develop organically. It brought a lifecycle service portfolio generating recurring revenue. It provided customer access and referencability within ecosystems where trust is built slowly. Additionally, it offered an expansion platform to strengthen Arvato’s global position in the Tech vertical.

As Arvato noted, ATC offers “a strong European network and specialized expertise” that Arvato can now expand through its global reach. In other words, Arvato acquired a playbook and the credibility to execute it.

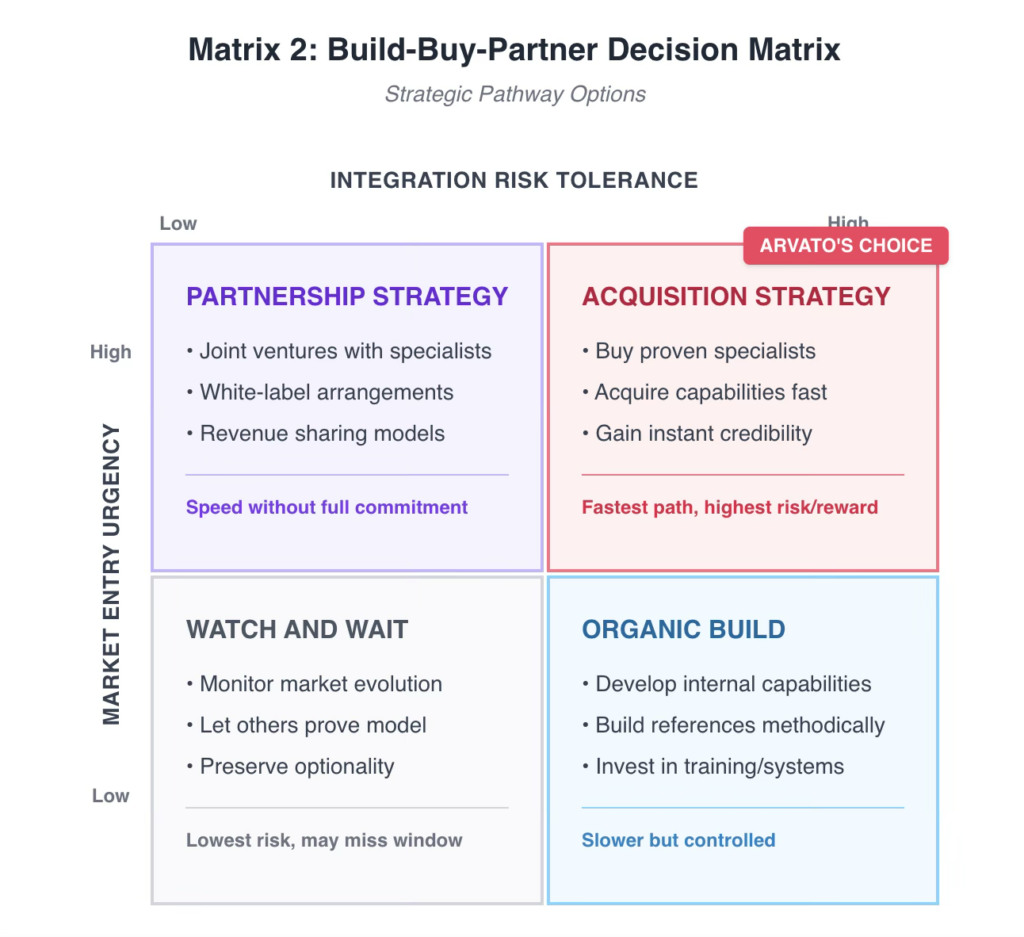

The Build-Buy-Partner Decision Matrix

For organizations considering entry or expansion in this space, the strategic pathway depends on two factors: urgency of market entry and tolerance for integration risk.

Strategic implication: Arvato’s decision to acquire rather than partner or build organically indicates their belief that the market opportunity is now and that, although integration risk exists, it is manageable. Organizations with lower risk tolerance or less urgency have alternative options, but the top positions could be claimed before they have the chance.

The Synergy Map: Revenue Expansion, Not Cost Cutting

In acquisitions within this area, the greatest synergy potential lies in boosting revenue rather than consolidating operations. Drucker’s insight is helpful: “Efficiency is doing things right; effectiveness is doing the right things.” Cost synergies highlight efficiency, while revenue synergies emphasize effectiveness, highlighting the importance of doing the right things to maintain premium market positions.

The first opportunity is to integrate specialist services into national and global accounts. Arvato can now incorporate ATC-style execution into larger supply chain frameworks: program-managed deployment waves across regions, integrated staging and secure warehousing, and site services delivered as an extension of transportation rather than through a separate vendor relationship.

The second opportunity and the more valuable one is shifting from initial deployments to ongoing lifecycle contracts. The highest switching-cost models include critical spare parts logistics, rapid swap programs, reverse logistics with controlled returns and packaging removal, modernization refresh cycles based on standardized operational playbooks, and decommissioning with secure chain of custody and certified disposition.

The third equally valuable opportunity is developing the “control tower” as a standalone product. Competitors are increasingly integrating visibility and KPI management as built-in features rather than optional add-ons. The control tower becomes a switching cost driver because it captures operational truth through exception management, compliance evidence, milestone tracking, and critical information that customers depend on for reporting and decision-making. When done correctly, a control tower filters out noise and reduces “alert fatigue,” allowing AI and people to concentrate on what truly matters in the moment.

The Control Tower: Operational Nervous System for Premium Execution

Drucker famously observed that “what gets measured gets managed.” In data center warehousing and logistics, the equivalent is equally vital: what gets measured in real-time is managed proactively, and proactive management is what differentiates premium operators from commodity providers.

A control tower for data center logistics is more than just a dashboard; it functions as the operational nervous system that delivers the service quality and visibility customers are willing to pay a premium for. Its architecture must be built on a foundation of reliable, proactive, and transparent Generative Business Intelligence (advanced AI designed for BI workflows), and it needs to include five functional layers.

Layer 1: Real-Time Shipment Visibility. GPS tracking, geofencing for site arrival confirmation, and carrier integration APIs that provide continuous position updates. The standard isn’t “where is my shipment today” but “will my shipment hit the four-hour site access window three days from now?”

Layer 2: Milestone and Exception Management. Automated tracking of milestones against committed schedules with configurable exception thresholds. When a shipment approaches missing a critical window, the system must alert beforehand—not after failure occurs. Exception resolution workflows with timestamped audit trails provide the compliance evidence hyperscale customers need.

Layer 3: Chain of Custody and Condition Monitoring. Integration with IoT sensors for shock, tilt, temperature, and humidity monitoring on high-value or sensitive shipments. Digital chain of custody documentation that creates an immutable record from origin through final placement. This layer turns “we delivered it” into “we can prove exactly what happened to it.”

Layer 4: Inventory and Spares Optimization. For ongoing operations, provide visibility into spare parts inventory across secure warehousing locations, consumption patterns, and replenishment triggers. Use perpetual inventory records and predictive analytics to forecast demand. Key inputs include installed base age, historical failure rates, and maintenance schedules. The aim is not just maximizing availability but ensuring the right parts are in the right locations with minimal carrying costs.

Layer 5: Performance Analytics and Continuous Improvement. Aggregate performance data across all operations with the ability to drill down by customer, site, lane, carrier, and service type. Includes root cause analysis tools that link exceptions to systemic issues. Provides benchmarking that supports both internal improvements and customer-facing performance reporting.

Control Tower KPI Framework

The metrics that define premium operator status must be measured at the control tower level with the following granularity:

| KPI Category | Metric | Premium Standard | Measurement Frequency |

| Schedule Performance | On-time-in-full at site appointment window | >99% | Real-time |

| Schedule Performance | Milestone completion vs. committed schedule | >98% | Daily |

| Exception Management | Exception identification to resolution time | <2 hours | Real-time |

| Exception Management | Root cause closure rate | >95% within 48 hours | Weekly |

| Asset Integrity | Damage and incident rate | <0.1% | Per shipment |

| Asset Integrity | Chain of custody audit completeness | 100% | Per shipment |

| Spares Operations | Critical spare part availability | >99% | Real-time |

| Spares Operations | Time to restore (from request to delivery) | <4 hours (local), <24 hours (regional) | Per incident |

| Financial Performance | Margin by lifecycle phase | Track deployment vs. operations vs. reverse | Monthly |

| Customer Health | Net promoter score by account | >70 | Quarterly |

Strategic implication: The control tower is not a cost center, it is the mechanism that produces the visibility, compliance evidence, and proactive management that justify premium pricing. Organizations that treat it as optional IT infrastructure misunderstand its strategic function.

The Risk Landscape

Four categories of risk deserve management attention.

Integration risk is likely the most urgent concern. The failure mode involves dilution of expert execution caused by implementing standardized, generic processes. Arvato has demonstrated awareness by emphasizing “seamless continuity” and maintaining operational integrity during integration. Whether they follow through on that commitment will determine if the acquisition adds or destroys value.

Concentration risk is inherent to the market. Hyperscalers hold significant bargaining power and can quickly change build locations. Providers reduce this risk by diversifying into OEM lifecycle programs, colocation operators, and recurring services that build relationships beyond any single deployment.

Service quality risk is critical in an environment that demands zero defects. The main failure modes include missing site access windows, handling damage, documentation or customs errors, and poor exception management. Any of these issues can permanently end a customer relationship.

Macro constraint risk means that even strong demand can be limited by power availability and supply chain delays in critical equipment. Growth projections assume constraints ease; if they don’t, the entire market timeline shifts.

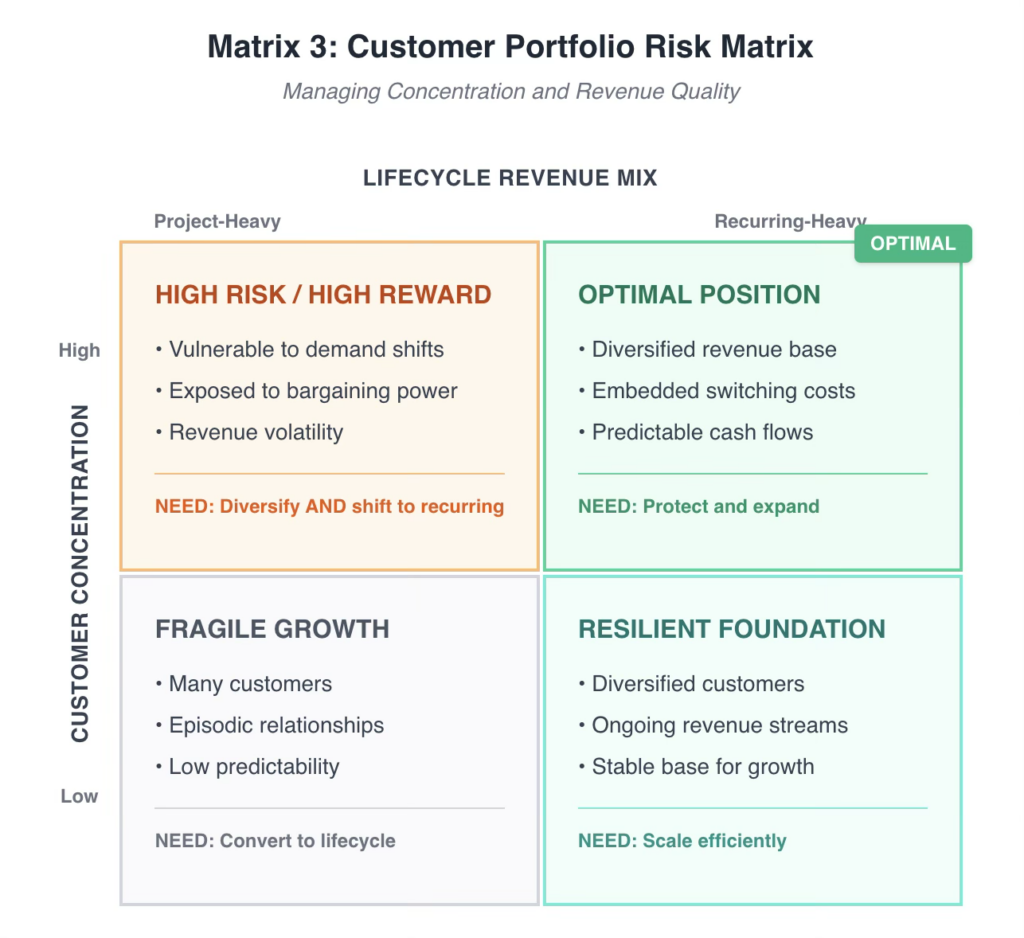

Risk-Opportunity Matrix: Customer Portfolio Strategy

Managing concentration risk requires deliberate portfolio construction across customer types and service phases.

Strategic implication: The safest route to sustainable growth is through the upper-right quadrant, but most providers begin in the upper-left (focused on projects) or lower-left (fragmented and project-focused). The strategic goal is to move right on this matrix by transforming deployments into ongoing lifecycle relationships.

Strategic Implications for Industry Leaders

For CEOs and PE owners in this industry and related fields, the Arvato-ATC deal highlights a strategic choice: focus on generalist logistics or specialized tech lifecycle services. These are increasingly distinct industries with different economics, competitive landscapes, and required skills.

Drucker’s advice resonates here: “The best way to predict the future is to create it.” Waiting to see how the market develops is itself a strategic choice that gives control to competitors who are actively shaping the landscape.

A practical decision framework emerges from this analysis. If you compete mainly on price, this market isn’t suitable for you; specialists will consistently outperform on the aspects that customers actually value. If you can manage risk, produce compliance evidence, and ensure milestone achievement, this could become a strong growth driver with economics far better than traditional logistics.

Key Actions and Strategic Questions

For CEOs: Strategic Positioning

Assess your current position honestly.

- Where does your organization stand on the Value-Defensibility Matrix? Are you competing in commodity freight, specialized execution, or integrated lifecycle services?

- What percentage of revenue is recurring compared to project-based? What is the trend over the last three years?

- Do customers see you as a vendor to be bid out or as infrastructure that would be expensive to replace?

Define your target position.

- Is the upper-right quadrant (embedded lifecycle partner) attainable with your capabilities, or is specialized execution a more realistic goal?

- What skills would you need to develop, and which could you organically develop?

- What is the realistic timeline to reach that position, and what market share might competitors claim in the meantime?

Stress-test your operational readiness.

- Can you provide chain-of-custody documentation and compliance evidence on demand for any shipment?

- Is your exception management proactive (identifying problems before they turn into failures) or reactive (documenting failures after they happen)?

- Do you have the site credentials, security clearances, and audit readiness that hyperscaler customers need?

For PE Investors: Investment Thesis and Due Diligence

Evaluate lifecycle coverage and revenue quality.

- What is the current mix across deployment, operations, maintenance, modernization, and decommissioning? Is the portfolio balanced, or is it focused on phases with low switching costs?

- What is the dollar retention rate for accounts over three and five years? Are customers expanding their scope or just repeating transactions?

- How would revenue and margins change if the five largest customers cut their volume by 50%?

Assess capability versus capacity.

- Is this a capability platform (specialized expertise, customer access, operational playbooks) or just capacity (trucks, warehouses, headcount)?

- What would be the time and cost to develop these capabilities organically?

- Are the key personnel who hold institutional knowledge and customer relationships retained and properly incentivized?

Examine the control tower and data foundation.

- Can management provide real-time visibility into shipment status, exceptions, and performance metrics?

- Is the data architecture capable of supporting proactive management, or does it only facilitate backward-looking reporting?

- What compliance evidence can be provided on demand, and what needs to be assembled manually?

Understand concentration and diversification.

- What does customer concentration look like in terms of revenue and margin contribution?

- What is the mix across hyperscalers, OEMs, colocation providers, and enterprise customers?

- How reliant is the business on a single geography or phase of the data center lifecycle?

For Boards: Governance and Risk Oversight

Challenge strategic assumptions.

- Is management’s market sizing based on realistic definitions, or does it conflate premium lifecycle services with commodity warehousing and logistics?

- What evidence shows that the organization can perform in zero-defect environments, not just aim for them?

- How would a failure in service quality at a major customer affect the business, and what controls are in place to prevent that outcome?

Monitor leading indicators.

- Is the board receiving metrics on leading indicators (such as exception trends, milestone risk, customer health) or only lagging indicators (like revenue, margin, incidents)?

- What early warning systems are in place for concentration risk, service quality decline, or integration problems (such as in acquisitions)?

- How often is competitive positioning reevaluated, and who conducts the assessment?

Evaluate M&A integration discipline.

- For acquisitions, what is the plan for preserving specialist capabilities while gaining scale benefits?

- What are the defined integration milestones, and who is responsible for each?

- What is the kill switch if integration is destroying rather than creating value?

For Operations Leaders: Execution Excellence

Build the control tower as a strategic asset.

- Does your current visibility infrastructure support proactive management or just reactive documentation?

- Can you predict if the site appointment window will be met 72 hours in advance, or do you only find out at the moment of arrival?

- What would be needed to provide customers with a branded visibility portal as part of your service, and would that increase switching costs?

Obsess over exception management.

- What is your current exception-to-resolution cycle time? What would it take to reduce it by half?

- Do you have a systematic root cause analysis to prevent recurrence, or do you keep solving the same problems over and over?

- Can you generate an exception audit trail for any shipment within minutes?

Institutionalize operational knowledge.

- Are your operational playbooks detailed enough for a new team member to perform to standard?

- What happens to customer relationships and operational knowledge if key personnel leave?

- How do you capture lessons learned from exceptions and near-misses?

The Question That Matters

Arvato’s acquisition of ATC signals clearly that high tech data center supply chain services are becoming a defensible niche where specialized operators can achieve durable growth through lifecycle contracts, embedded workflows, and compounding switching costs.

The market size question, “How big is this opportunity?” is the wrong starting point. The right question is more challenging: Can your organization become the embedded lifecycle operator that customers cannot afford to leave?

That requires capabilities most 3WPL providers don’t have, integration depth most are reluctant to pursue, and operational excellence most can’t maintain. For those who can deliver, the economics are outstanding. For those who can’t, the data center buildout will remain someone else’s opportunity.

Drucker offered a key insight worth remembering: “Management is doing things right; leadership is doing the right things.” In data center logistics, doing things right, such as flawless execution, zero defects, and perfect compliance, is the entry fee. But leadership means doing the right things: choosing to compete on value instead of price, investing in control tower capabilities before competitors, and building lifecycle relationships that turn customers into partners.

The buildout is happening. The constraints are real. With hyperscaler deployment cycles typically running 18-36 months, providers who aren’t positioned within the next 12-18 months may find that many premium partnerships are already allocated.